Unlocking Global Private Assets

The digital bridge that unlocks distribution and liquidity for asset managers and investors in private markets

About Pontoro

Pontoro Inc. is a venture-backed FinTech company developing a digital operating system for the private fund industry. Our framework integrates technical, legal, and regulatory protocols to convert traditionally illiquid fund interests into liquid investments, thereby improving distribution and increasing capital flows and participation. Our mission is to provide liquidity, greater access, transparency, and customization to private fund participants facilitated by our digital operating system.

Building the Full Tokenization Value Chain

We've designed a novel and simplified fund structure using distributed ledger technology to enhance liquidity, enable portfolio customization, and improve investor access.

How do we do this?

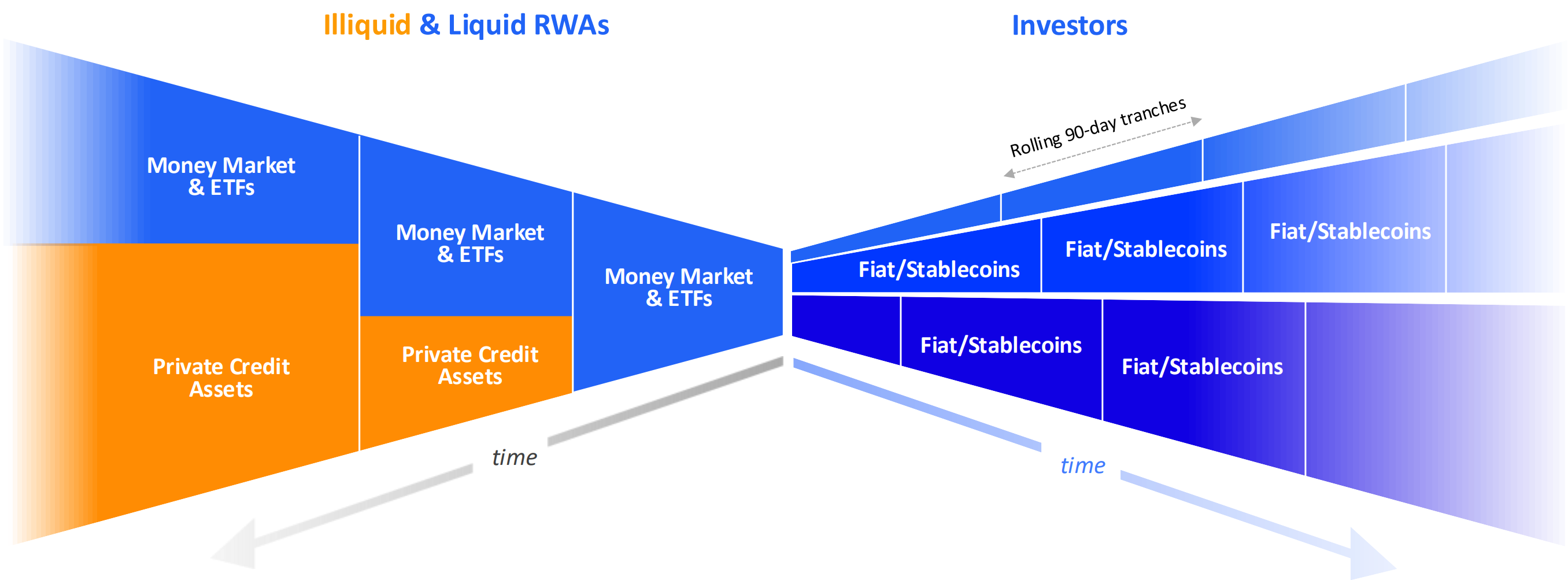

Automated Liquidity Pools

Pontoro's ALP is inspired by DeFi's Automated Money Market (AMM) pools, but applied to private markets, combining high quality, daily liquid instruments and illiquid private credit fund interests. Pontoro's platform and proprietary algorithm dynamically manage liquidity and yields by optimizing real-time asset allocation.

The ALP algorithm creates a

Dynamic Equilibrium

As liquidity decreases, the ALP algorithm increases discounts on private assets, boosting yields to attract liquid capital and balance the pool. Conversely, as liquidity rises, discounts decrease to encourage private asset inflows, reducing liquid capital inflows and restoring equilibrium.

Value Generators of the ALP

Our Automated Liquidity Pool unlocks liquidity and access to private assets through three key mechanisms

Value Distribution & Fractionalization

The ALP spreads private asset value across multiple investors & over time, increasing accessibility and asset fractioanlization.

No Need for 1:1 Matching

By eliminating direct counterparty matching, the ALP reduces negotiation time and costs and expedites transactions

Perpetual Pricing Signal

Unlike traditional opaque methods, ALP preserves and propagates pricing signals over an ever-increasing participant bas

Higher Yield while Maintaining Liquidity

The ALP gives investors access to enhanced yield from private assets with quarterly liquidity.

Our Venture Investors

Why Pontoro?

(Ponte aureo [latin], definition: bridge of gold)

Interested in your own ALP?

If you are a fund manager who wants to set up their own ALP for their funds and more, please contact us at:

Meet Our Team

Our team combines decades of senior-level experience in institutional private assets, financial regulation, and technology from top institutions like JP Morgan, Citigroup, BlackRock, UBS, GE Capital, and Morgan Stanley Investment Management.